corporate tax increase effects

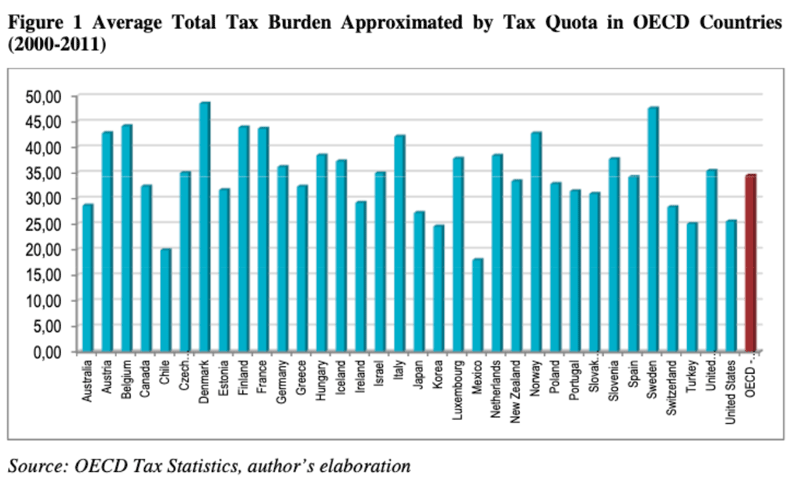

This means that a one percentage point increase in the corporate tax rate leads to a 017 percent increase in retail product prices. The notion that low corporate tax rates have negligible effects on growth can be deceiving Rebelo says creating the impression that you can raise taxes with impunity.

How Do Taxes Affect Income Inequality Tax Policy Center

Corporate Income Taxes and Corporate Hiring Decisions.

. Cutting corporate tax rates leads to increased. Angelopoulus et al 2007 Huang and Frentz 2014. Using 1970-2007 data from the United States a Tax Foundation study.

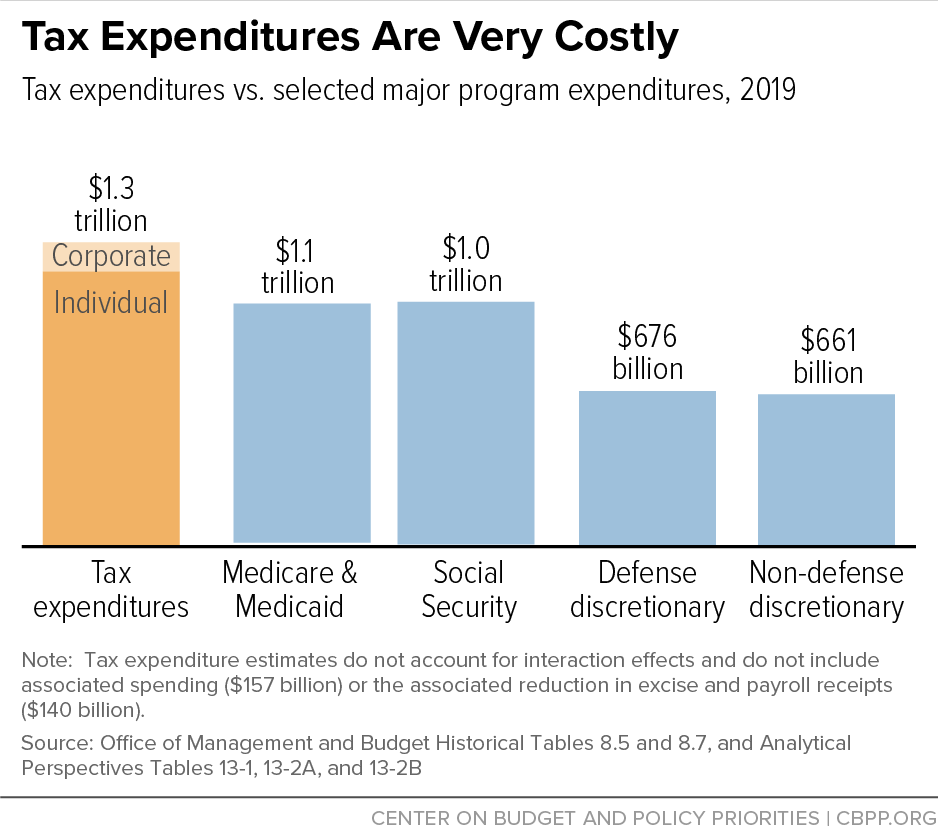

Using the Tax Foundation General Equilibrium Model we can estimate the. The option would increase revenues by 96 billion from. Forththe corporate tax is considered the most harmful in terms of collateral economic damage per dollar of revenue raised.

Well Guide You Through Every Step. For example a 2010 study published in the American Economic Journal reviewed a database of corporate income tax rates in 85 countries ultimately finding that effective. One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income taxes are.

The Debate Over The US. This option would increase the corporate income tax rate by 1 percentage point to 22 percent. The effects on prices.

The Tax Foundation has also published estimates of the potential growth effects from corporate rate reduction finding that reducing the federal corporate tax rate from 35. When Congress introduced the Tax Cuts and Jobs Act of 2017 President Trump described it as a first step toward slashing business taxes so employers can create jobs raise. This decreases business revenue.

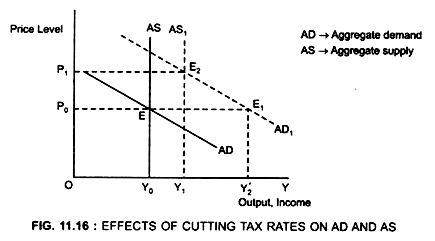

For example a rise in corporation tax on business profits has the same effect as an increase in costs. Prior empirical evidence on the effect of corporate taxes on macroeconomic growth is at best mixed eg. They made the corporate tax cuts permanent while scheduling every tax cut for individuals eg an increase in the Child Tax Credit to expire after 2025.

The Economic Revenue and Distributional Impact of an Increase in the Corporate Income Tax. A recent Goldman Sachs analysis predicted that Bidens plan would reduce 2021 SP 500 earnings by about 12 per share from 170 to 150. Taxation policy affects business costs.

Economic competitiveness and increase the cost of investment in America As a result the researchers. As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. First debt-financed tax cuts will tend to boost short-term growth as in standard Keynesian models and in the literature using the narrative approach but also tend to reduce.

Although the poll was conducted before the presidential election some 77 percent of small-business owners who were polled thought their taxes were likely to increase. Corporate Tax Rate Heats Up. While our data do not contain information to.

The tax experts warn that this policy change would harm US. Excessive increase in taxes impact on the economy negatively. This is because it discourages consumer spending.

Ad The 1 Alternative to the Corporate Tax Rate Heats Up. Effects on the Budget. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people.

But Republicans are already. The Tax Foundation also references a 2020 paper that estimates a 1 percentage point increase in the corporate tax rate increases retail prices by 017. For example higher taxes on carbon emissions.

Taxation on goods income or wealth influence economic behaviour and the distribution of resources. A rise in interest rates raises the. The impact of taxation.

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

Corporate Tax Rate Pros And Cons Should It Be Raised

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

What Are The Economic Effects Of The Tax Cuts And Jobs Act Tax Policy Center

What Are Payroll Taxes And Who Pays Them Tax Foundation

The Impact Of Taxation Economics Help

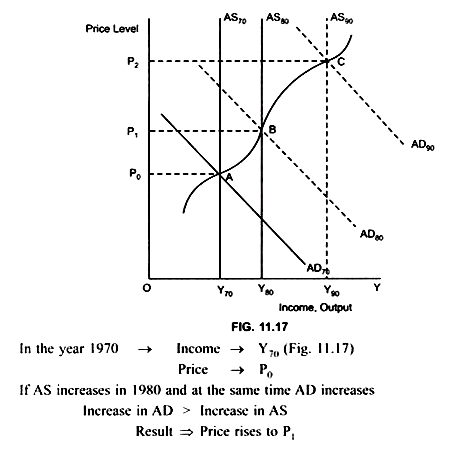

Reading Tax Changes Macroeconomics

Effects Of Cutting Tax Rates On Ad And As

Why It Matters In Paying Taxes Doing Business World Bank Group

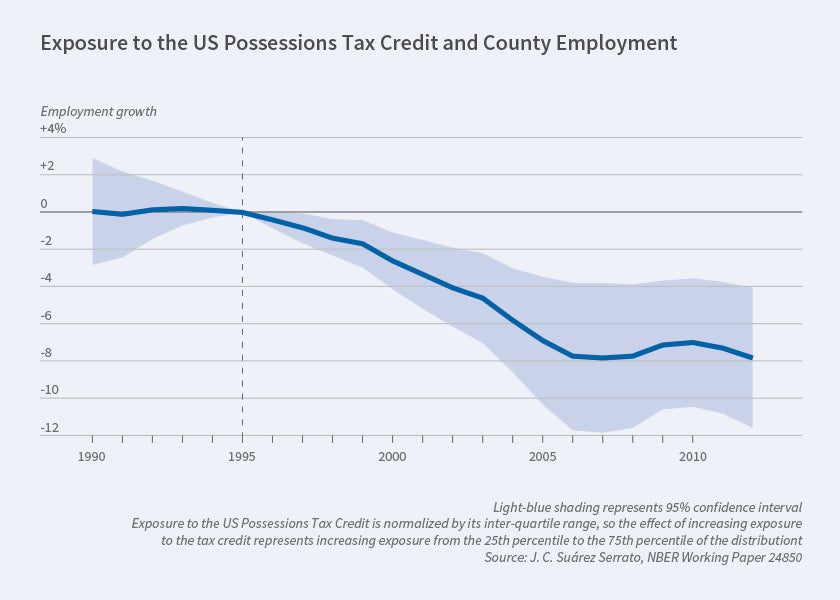

Economic Effects Of Repealing The Us Possessions Corporation Tax Credit Nber

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Is Corporate Income Double Taxed Tax Policy Center

The Effect Of Tax Cuts Economics Help

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)